The Future of Digital Wallets: How Mobile Payments are Shaping the Financial Landscape

The financial world is changing rapidly, and one of the most significant developments in recent years is the rise of digital wallets. Mobile payments are transforming the way people manage, transfer, and spend money. From simple in-store purchases to complex online transactions, mobile wallets are revolutionizing the financial landscape.

As we look ahead, it’s clear that the future of digital wallets is not just about convenience; it’s about security, efficiency, and integration with other aspects of our daily lives. In this blog, we’ll explore how mobile payments are shaping the future of finance and the key trends driving their widespread adoption.

The Shift to Contactless Payments

In the past, traditional payment methods like cash or physical credit and debit cards were the norm. However, with the advent of contactless payments, mobile wallets have taken the lead. Contactless payments allow consumers to pay with just a tap of their phone, watch, or other smart devices—without needing to physically swipe or insert a card.

This shift was accelerated by the COVID-19 pandemic, as people sought safer, more hygienic ways to make purchases. In fact, contactless payments have become so popular that many retailers now offer discounts for contactless transactions, making it an even more attractive option.

NFC Technology: The Backbone of Digital Wallets

The backbone of many mobile wallets is Near Field Communication (NFC) technology. NFC allows for secure, wireless communication between your device and the payment terminal, enabling fast and easy transactions.

NFC-based mobile wallets like NFC-Pay are at the forefront of this innovation. By securely storing payment details on your device, NFC wallets eliminate the need for physical cards, reducing the risk of fraud and making payments faster and more convenient.

Enhanced Security Features

One of the key concerns with digital wallets is security. As mobile payments become more widespread, the need to ensure data protection and prevent fraud is paramount. Fortunately, mobile wallets have several built-in security features designed to protect users' financial information.

Encryption and Tokenization

Technologies like encryption and tokenization are commonly used by digital wallets to enhance security. Encryptionensures that payment data is scrambled during transmission, making it unreadable to unauthorized parties. Tokenizationreplaces sensitive information, such as credit card numbers, with unique, non-reversible tokens, reducing the risk of data breaches.

At NFC-Pay, both encryption and tokenization are used to ensure that your payment details are kept safe while making purchases, offering peace of mind when using the app.

Biometric Authentication

Another significant security feature of mobile wallets is biometric authentication. Whether it’s a fingerprint scan or facial recognition, these features add an extra layer of protection by ensuring that only the account holder can authorize transactions.

As mobile devices continue to evolve, biometric authentication will become an even more integral part of securing digital wallets and preventing unauthorized access.

The Integration of Digital Wallets with Other Services

The future of digital wallets is not limited to payments alone. These wallets are rapidly evolving into comprehensive digital ecosystems that integrate with various services beyond just money management.

Loyalty Programs and Rewards

Many digital wallets now allow users to store loyalty cards and redeem rewards directly from the wallet app. For example, mobile wallet users can earn points for purchases and then use those points for discounts or other rewards—without needing to carry physical cards.

As digital wallets continue to evolve, they will likely integrate even more services, such as insurance, banking, loans, and investment options, creating a one-stop solution for managing personal finances.

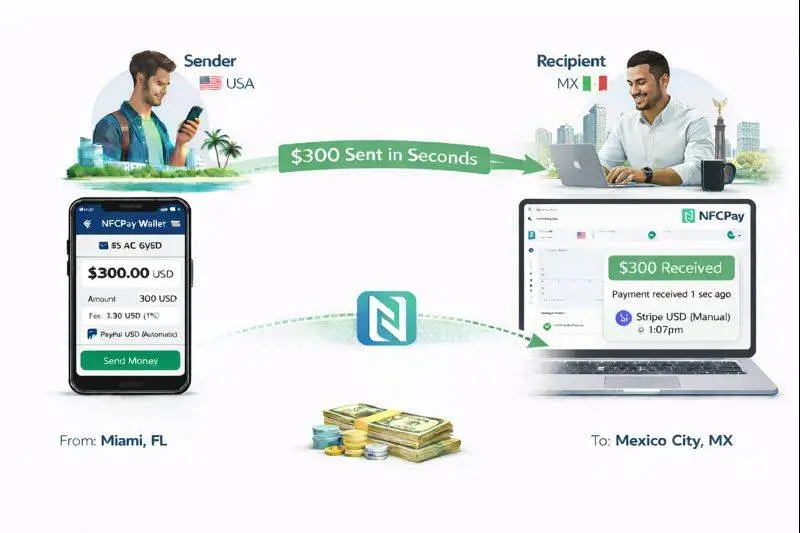

Cross-Border Payments

As globalization continues to grow, the need for seamless cross-border payments is increasing. Traditional banking systems and wire transfers can be slow and expensive. Mobile wallets are stepping in to provide quicker, cheaper alternatives, making international transactions easier than ever.

Services like NFC-Pay already offer fast and affordable international payments, allowing users to send money across borders with just a few taps, cutting down on the cost and hassle associated with traditional bank transfers.

The Role of Artificial Intelligence in Digital Wallets

Artificial Intelligence (AI) is already playing a significant role in the development of digital wallets, and it’s set to become even more important in the future. AI algorithms can help mobile wallets offer personalized experiences by analyzing users’ spending habits and providing tailored recommendations.

For instance, AI-powered digital wallets can:

Track spending patterns and suggest budgeting strategies.

Offer real-time fraud detection, notifying users of suspicious activity immediately.

Assist with automated savings by rounding up purchases and saving the change.

By integrating AI into digital wallets, companies can provide more personalized, intuitive services that help users manage their finances more effectively.

The Road Ahead for Digital Wallets

The future of digital wallets is incredibly bright, with ongoing advancements in security, technology, and integration. Mobile payments are no longer just a trend—they’re becoming an essential part of how we interact with money and financial services.

As digital wallets continue to evolve, they will become even more secure, efficient, and integrated into our daily lives. From easier international payments to seamless loyalty programs, the next generation of digital wallets will offer a more connected, streamlined experience for users around the world.

At NFC-Pay, we’re excited to be at the forefront of this evolution, helping users embrace the future of mobile payments and financial freedom.

Start Today with NFC-Pay

Ready to experience the future of digital wallets? Download NFC-Pay for Android today and start making secure, contactless payments with ease.

Coming soon for iOS

Visit nfc-pay.com to learn more and explore how our platform is shaping the future of mobile payments.